7 Ways to Master Forex Trading

Welcome to the world of Forex Trading, where creativity meets financial success. In this article, we will explore 7 incredible strategies that will help you master the art of Forex Trading. Before we dive into these strategies, let’s first understand the basics of Forex Trading.

Understanding the basics of Forex Trading

Forex Trading, short for foreign exchange trading, is the process of buying and selling currencies in the global market. Unlike other markets, Forex Trading operates 24/7, making it an appealing investment option for individuals looking to make profits at any time of the day. With its high liquidity and potential for significant returns, Forex Trading has become increasingly popular among investors worldwide.

Why Forex Trading is a popular investment option

Forex Trading offers numerous advantages, including low transaction costs, the ability to trade with leverage, and the opportunity to profit from both rising and falling markets. Additionally, the Forex market is the largest financial market globally, making it easily accessible and providing ample trading opportunities.

The importance of mastering Forex Trading

Mastering Forex Trading is crucial for consistent success. With proper knowledge and skills, you can navigate the complexities of the market, identify profitable trades, and manage risks effectively. By mastering Forex Trading, you increase your potential for substantial financial gains and discover a world of endless possibilities.

Immerse yourself in the world of Forex Trading as we delve into the 7 must-know strategies that will elevate your trading game. Get ready to unleash your creativity and embark on a journey towards financial prosperity.

1. Developing a Solid Foundation

Educating yourself about the Forex market

To successfully master Forex trading, it is crucial to start by developing a solid foundation. This begins with educating yourself about the Forex market. Dive into resources that offer comprehensive information on how the market operates, the various participants involved, as well as the different trading styles and strategies that can be employed.

Learning about different currency pairs

Within the Forex market, there are numerous currency pairs that you can trade. Each pair has its own unique characteristics and factors that influence its movements. Take the time to study and understand the dynamics of different currency pairs, such as major and minor pairs, and how they interact with one another. This knowledge will help you make more informed trading decisions.

Understanding fundamental and technical analysis

To master Forex trading, it is essential to have a deep understanding of both fundamental and technical analysis. Fundamental analysis involves studying economic indicators, geopolitical events, and news that impact currency values. On the other hand, technical analysis involves analyzing price charts, patterns, and indicators to predict future price movements. Familiarize yourself with both approaches to gain a well-rounded perspective on the market.

By developing a solid foundation through education, learning about different currency pairs, and understanding fundamental and technical analysis, you are setting yourself up for success in Forex trading. These crucial first steps will provide you with the necessary knowledge and skills to navigate the Forex market and make informed trading decisions. Mastering Forex trading requires patience, practice, and continuous learning, so embrace the creative journey ahead and unlock the potential for financial freedom.

2. Setting Clear Goals and Strategies

When it comes to mastering forex trading, setting clear goals and strategies is absolutely crucial. Without a well-defined plan in place, you may find yourself getting lost and making impulsive decisions that can negatively impact your trading success. This section will guide you through the process of establishing clear goals and developing effective strategies to achieve them.

Defining your trading goals

The first step in setting clear goals is to understand what you want to achieve as a forex trader. Ask yourself: What are your financial objectives? How much time can you dedicate to trading? Do you aim to generate a steady income or grow your wealth over the long term? Answering these questions will help you define realistic and attainable goals that will guide your trading journey.

Creating a trading plan

Once you have a clear understanding of your goals, it’s time to develop a comprehensive trading plan. This plan should outline your trading approach, including the currency pairs you will focus on, the timeframes you will trade, and the risk management strategies you will implement. Additionally, your plan should include your entry and exit criteria, as well as your profit targets. Having a well-thought-out trading plan will keep you focused and disciplined in the face of market volatility.

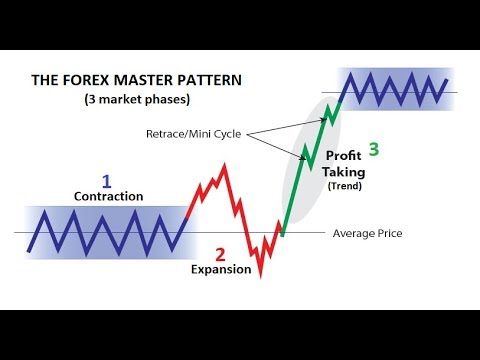

Identifying and utilizing effective trading strategies

To master forex trading, it’s essential to identify and utilize effective trading strategies. This involves studying and analyzing different approaches, such as trend following, range trading, or breakout trading. Experiment with various strategies to find the ones that align with your goals and trading style. Remember to backtest and demo trade your chosen strategies before implementing them with real money.

By setting clear goals, creating a trading plan, and utilizing effective strategies, you will position yourself for success in forex trading. These essential steps ensure that you stay on track and make informed decisions based on your objectives and analysis. So, take the time to establish your goals, craft a solid trading plan, and explore different strategies. With a creative mindset and dedication, you’ll be on your way to mastering forex trading.

3. Managing Risk Effectively

Understanding Risk Management Principles

To master forex trading, it is crucial to have a deep understanding of risk management principles. This involves identifying and assessing potential risks while also developing strategies to mitigate them. By analyzing market trends and carefully considering factors such as economic indicators and geopolitical events, you can make informed decisions and minimize the risks associated with forex trading. It is important to constantly stay informed and adapt your risk management strategies as market conditions change.

Setting Appropriate Stop-Loss and Take-Profit Levels

Another key aspect of managing risk effectively is setting appropriate stop-loss and take-profit levels. A stop-loss order protects you from significant losses by automatically closing a trade if the market moves against you, while a take-profit order allows you to lock in profits when the market reaches a predetermined level. By setting these levels based on your risk tolerance and market analysis, you can ensure that your trades are managed in a disciplined and strategic manner.

Using Leverage Wisely

Leverage can be a powerful tool but should be used wisely. It allows you to control a larger position with a smaller investment, amplifying potential profits. However, it also increases the potential for losses. Before utilizing leverage, it is important to fully understand its implications and assess your risk appetite. By using leverage responsibly and having a clear plan in place, you can effectively manage the associated risks and improve your chances of success in the forex market. Remember, prudent risk management is essential for long-term profitability and sustainability in forex trading.

4. Mastering Technical Analysis

Technical analysis is a crucial aspect of mastering forex trading. By learning how to read charts and identify patterns, you can gain valuable insights into market trends and make more informed trading decisions.

Learning how to read charts and identify patterns

To master technical analysis, you need to understand the various chart types and their components. Candlestick charts, line charts, and bar charts are some commonly used chart types in forex trading. By analyzing these charts, you can identify patterns such as support and resistance levels, trend lines, and chart formations like double tops or head and shoulders.

Utilizing indicators and oscillators effectively

Indicators and oscillators are tools that help traders identify potential entry and exit points. They can provide valuable information about price momentum, overbought or oversold conditions, and trend strength. Popular indicators like moving averages, Relative Strength Index (RSI), and MACD can be used to enhance your technical analysis skills.

Applying technical analysis in making trading decisions

Once you have mastered reading charts and using indicators, you can apply this knowledge to make more informed trading decisions. Technical analysis can help you determine optimal entry and exit points, set stop-loss and take-profit levels, and identify potential trend reversals. By combining technical analysis with other fundamental and sentiment analysis techniques, you can develop a comprehensive trading strategy.

Mastering technical analysis requires practice and continuous learning. By dedicating time and effort to understand charts, indicators, and their applications, you can enhance your forex trading skills and increase your chances of success. So, start honing your technical analysis skills today and take your forex trading to the next level.

5. Incorporating Fundamental Analysis

When it comes to mastering forex trading, it’s essential to incorporate fundamental analysis into your repertoire. By understanding and analyzing macroeconomic factors that affect currency pairs, you can gain significant insights into market trends and make informed trading decisions.

Staying updated with economic news and events

To effectively employ fundamental analysis, you need to stay up-to-date with the latest economic news and events globally. This includes monitoring key indicators such as GDP, inflation rates, employment data, and central bank decisions. By keeping a close eye on these factors, you can anticipate market movements and trade accordingly.

Analyzing macroeconomic factors that affect currency pairs

Fundamental analysis involves examining the broader economic climate and how it impacts currency pairs. Factors like political stability, geopolitical tensions, and trade policies can heavily influence exchange rates. By thoroughly analyzing these macroeconomic indicators, you can identify potential opportunities and risks in the forex market.

Using fundamental analysis to complement technical analysis

While technical analysis focuses on chart patterns and indicators, fundamental analysis provides a broader perspective on market trends. By using both approaches in tandem, you can enhance your trading strategies and make more accurate predictions. Fundamental analysis helps you understand the “why” behind market movements, while technical analysis helps you pinpoint the “when” to enter or exit trades.

By incorporating fundamental analysis into your trading arsenal, you can gain a deeper understanding of market dynamics and increase your chances of success. So, ensure you stay informed about economic news, analyze macroeconomic factors, and combine your findings with technical analysis to master forex trading.

6. Practicing Discipline and Emotional Control

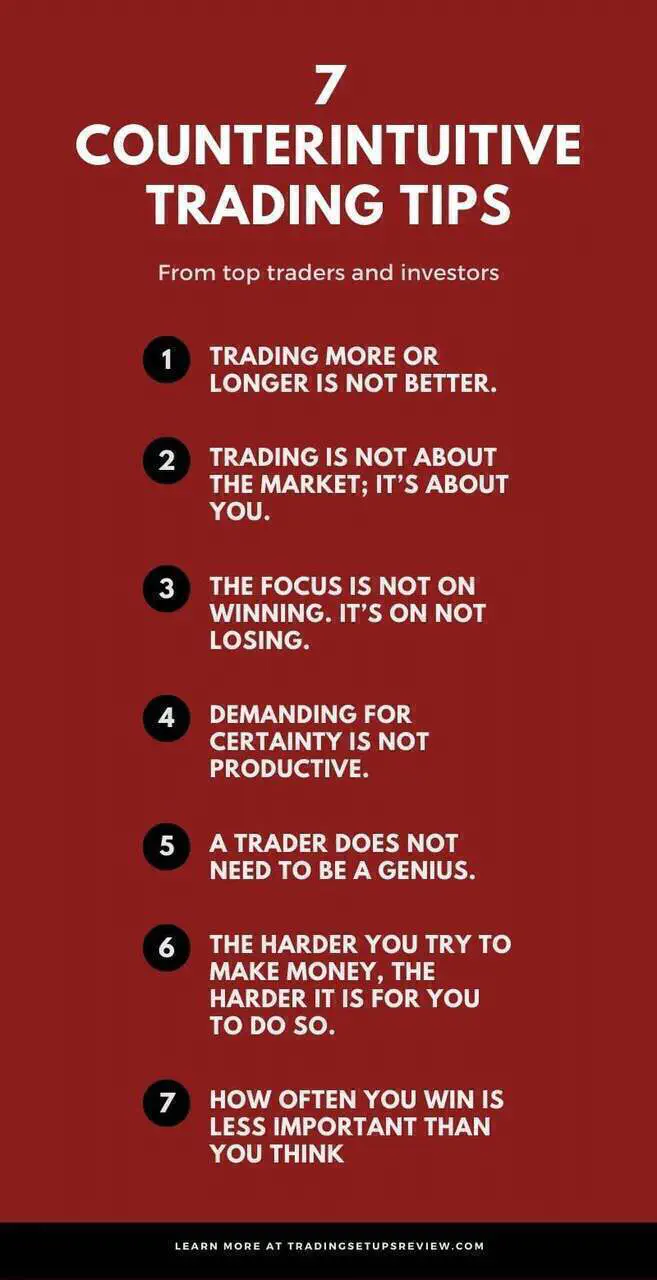

Maintaining discipline in executing your trading plan

One of the fundamental aspects of mastering forex trading is maintaining discipline in executing your trading plan consistently. This means adhering to your predetermined trading strategies and not deviating from them based on emotions or external factors. By sticking to your plan, you ensure that your trading decisions are based on analysis and not influenced by fleeting market trends.

Controlling emotions and avoiding impulsive decisions

Controlling your emotions is another crucial component of successful forex trading. Emotional decisions driven by fear or greed can lead to impulsive and irrational moves that may result in significant losses. It is essential to detach yourself emotionally from your trades and make decisions based on logical analysis rather than letting impulses dictate your actions. This requires self-control and an ability to stay calm even in the face of unexpected market movements.

Developing a resilient mindset to handle losses

Losses are an inevitable part of forex trading, and it is crucial to develop a resilient mindset to handle them effectively. Instead of dwelling on losses or letting them affect your confidence, view them as learning opportunities. Analyze your mistakes, reassess your strategies, and make adjustments accordingly. Remember that losses are a part of the learning process and can contribute to your growth as a trader.

Mastering discipline and emotional control are essential if you want to excel in forex trading. By maintaining discipline in executing your trading plan, controlling your emotions, and developing a resilient mindset to handle losses, you increase your chances of success in this dynamic and challenging market. Remember, practice makes perfect, and with dedication and perseverance, you can become a master of forex trading.

7. Continuous Learning

The forex market is constantly evolving, and staying updated is essential. Continuously educate yourself, attend webinars, read books, and follow expert traders to enhance your trading skills and adapt to market changes.

Continuous learning in forex trading offers numerous benefits. It helps traders stay updated with market trends, understand fundamental and technical analysis, develop effective strategies, manage risks, and leverage trading tools and technology. Furthermore, it enhances traders’ knowledge of news and economic events, enables them to learn from mistakes, expand their forex education, and build valuable connections with other traders.

Conclusion

Reflecting on the importance of mastering Forex Trading

Congratulations! You have just explored the 7 essential strategies that can help you master Forex trading. This insightful journey has equipped you with the knowledge and tools necessary to navigate the exciting world of foreign exchange. With these strategies in your arsenal, you are now better prepared to make informed decisions that can lead to success in Forex trading.

Encouragement to implement the learned strategies

Now that you have learned these strategies, it’s time to put them into action. Embrace the mindset of a creative trader, and remember that practice makes perfect. Take advantage of demo accounts to test your skills and gain confidence before committing real funds. By implementing these strategies consistently, you will see how they can enhance your trading abilities and improve your overall results.

Highlighting the potential benefits of successful Forex Trading

By mastering Forex trading, you open yourself up to a world of possibilities. The potential benefits include financial independence, flexibility, and the ability to generate income from anywhere in the world. With dedication and discipline, you can develop a profitable trading system that suits your unique style and goals. Remember that the key to success lies in staying informed, being patient, and adapting to market trends.

In conclusion, mastering Forex trading takes time and effort, but the rewards are well worth it. By implementing the strategies outlined in this article, you can increase your chances of achieving success in this dynamic and lucrative market. So go ahead, dive into the world of Forex trading with confidence and creativity, and watch your trading skills soar to new heights.